are political contributions tax deductible in oregon

As of 2020 four states have provisions for dealing with political contributions. Montana offers a tax deduction.

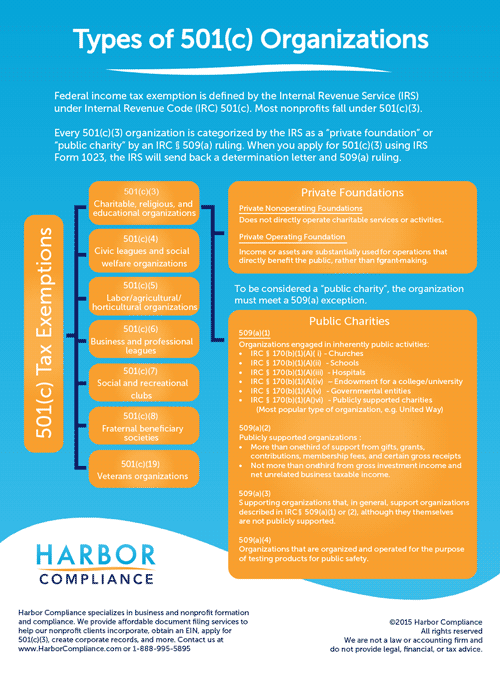

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

. If you owe taxes you can subtract your contribution from what you owe. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

12 2013 445 pm. Individuals cannot deduct contributions made to political campaigns on their federal tax returns regardless of whether they itemize or claim the standard deduction. Your contribution can help us protect gun rights and cost you nothing.

It is not deductible for Federal. The IRS guidelines also go beyond just direct political contributions. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction.

If you have not made a donation to Oregon Firearms Political Action Committee in 2015 please consider the advantages. Some political organizations may operate as a dual-purpose organizations or have dealings using segregated funds or newsletter funds. This is an actual credit against any money you owe the.

Individuals cannot deduct contributions made to political campaigns on their federal tax returns regardless of whether. 12 2013 445 pm. Donations to OFFPAC qualify for a tax credit of up to 10000.

There are five types of deductions for individuals work. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. Arkansas Ohio and Oregon offer tax credits.

No longer for the rich. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

The answer is no donations to political candidates are not tax deductible on your personal or business tax return. Political contributions arent tax deductible. However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations.

Political contributions are not tax deductible though. All four states have rules and limitations around the tax break. Any money voluntarily given to candidates campaign committees lobbying groups and other political organizations is non-deductible as per the IRS.

Oregons political contribution tax credit. If the state owes you a refund they will add it to your refund check. In a nutshell the quick answer to the question Are political contributions deductible is no.

While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns. A tax deduction allows a person to reduce their income as a result of certain expenses. When you are in the State Taxes section for Oregon there is a screen titled Political Contribution Credit where you are able to enter the amount of your Oregon political contributions you are referring to.

Charitable contributions claimed as Oregon tax payments. Donations to OFFPAC qualify for a tax credit of up to 10000. Oregon allows you to subtract donations to political groups or campaigns from your state taxes - up to 50 for individuals or 100 for couples filing jointly.

Are Political Donations Tax Deductible. Political contributions are not tax deductible though. This screen will be seen after the Adjustments Summary screen.

Thats not a mere deduction. Political contributions deductible status is a myth. Political donations deductions in oregon.

You cant deduct political contributions dues paid to fraternal organizations or the value of any services or benefits you received in connection with. The tweak to Oregons tax credit for political contributions. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

Exempt-function income thats taxable for federal purposes under IRC 527i4 is also taxable by Oregon. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. Gambling losses claimed as itemized deduction 604 Federal estate tax 605 Federal mortgage interest credit 607 Federal tax credits 609 Child Care Fund contribution 642 Oregon Production Investment Fund contributions 644 University Venture Development Fund contributions 646 Oregon IDA Initiative Fund donation credit add-back 648.

The same goes for campaign contributions. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. Note that there is a difference between the two.

Expenses accrued while earning this income are deductible. Oregon State Political Contribution Credit rcsroper Although you can enter the contribution in TurboTax even if your income is over 150000 it will be flagged when the mandatory review is done before you file your tax return and you will need to. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction.

Are Gofundme Donations Tax Deductible We Explain

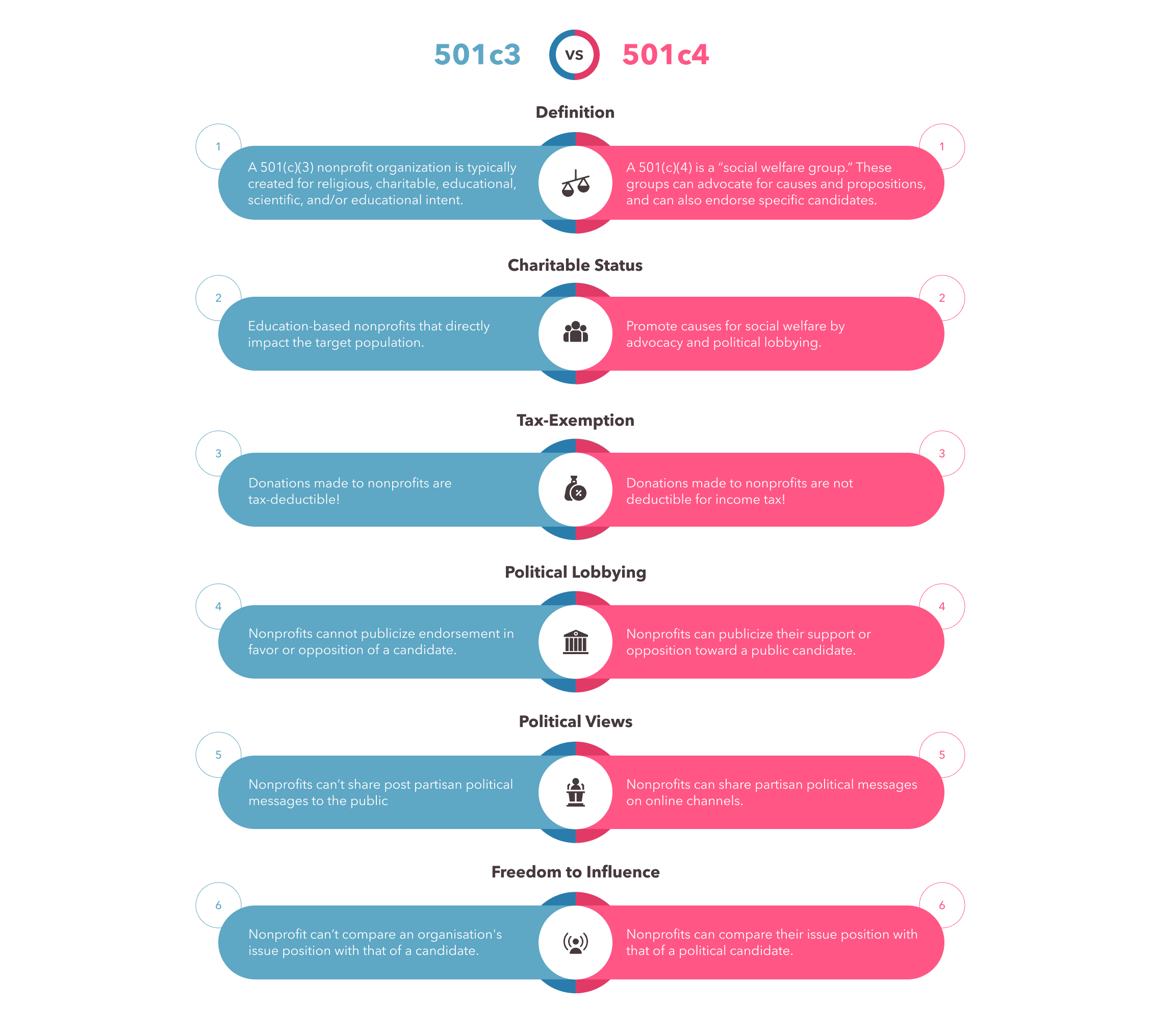

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Tax Burden By State 2022 State And Local Taxes Tax Foundation

State And Local Tax Treatment Of Charitable Contributions Us Charitable Gift Trust

Help Us Distribute The Christian Voter S Guide Oregon Family Council

Rnli 1980s Via Www Andrewpapworth Co Uk Charity Fundraising Retro Advertising Saving Lives

Who S Who In Oregon Politics Forward Together

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Are Gofundme Donations Tax Deductible We Explain

Use Your Political Tax Credit To Defend Reproductive Freedom In 2022 Planned Parenthood Advocates Of Oregon